Tax Credit Alliance of Nebraska

Help Us Help Others. Volunteer with TCAN!

Free Tax Help for Nebraska Residents

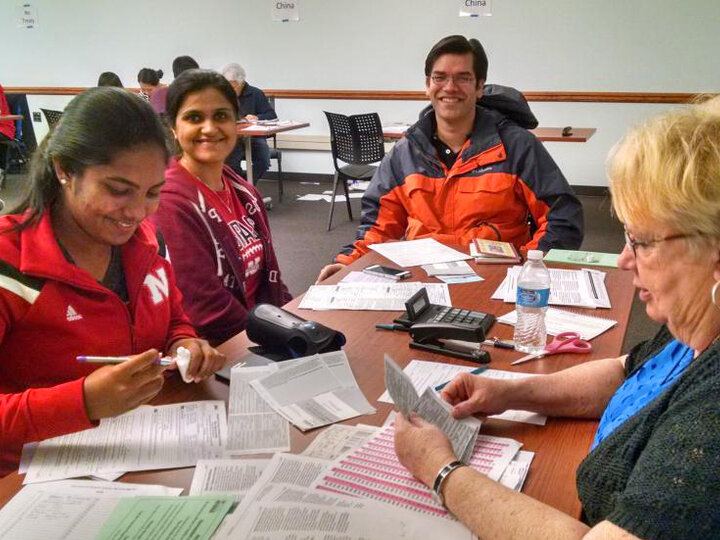

The Tax Credit Alliance of Nebraska (TCAN) offers free tax preparation and support services across the state through the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs.

Our Internal Revenue Service (IRS)-sponsored program is part of the University of Nebraska–Lincoln’s Center on Children, Families, and the Law, and is staffed by IRS-certified volunteers trained each year on the latest tax laws.

We serve individuals and families with low-to-moderate income, people with disabilities, non-filing households with children, English language learners, students, and older adults. View our brochure!

The Vault - Volunteer Login

The Vault gives volunteers a simple, secure way to stay connected with the program. Use it to sign up for volunteer shifts, view your schedule, record and track service hours, and receive important messages and updates—all in one place, whenever and wherever it’s convenient.

Help for working parents and families

Nebraska’s refundable Child Care Tax Credit for Working Parents can help ease the pressures on families and make providing for their little ones just a little easier.

Home page cards

Want to Partner with TCAN?

Explore ways your organization can collaborate with TCAN to support Nebraska communities.

Get Help Filing Your Taxes

This page outlines the different tax preparation and filing services available, including options for international students, off-season filing, and more.

Financial Education

Get clear, timely tips on taxes, budgeting, and more when you subscribe to our Financial Education Newsletter.