Filing taxes in the U.S. can be confusing - especially if you're an international student. This FAQ is designed to help answer some of the most common questions, whether you're figuring out if you need to file, how to file, or what to do if something goes wrong.

We hope this guide helps make the process a little easier and less stressful. If you don’t find the answer you’re looking for, don’t hesitate to reach out for support.

Do I have to file a tax return? Do You have a Tax Filing Obligation?

In calendar year 2025, if you worked and received income on one or more of the following forms: Form W-2, Form 1099-Misc or NEC, Form 1099-INT, and or Form 1042-S.

If so, you will need to prepare and e-file Form 1040NR and Form 8843, Statement of Exempt Individuals for you (Part 1, Part 2 or 3) and each dependent (Part 1 and sign page 3) living with you in the US must be USPS mail to Austin, Texas.

If not, prepare and send Form 8843 for you (Part 1 & 2) and each dependent (Part 1 and sign page 3) living with you in the US to Austin, TX by June 15

If you meet tax residency requirements in 2024, you will need to prepare and e-file Form 1040.

If you are an international student or scholar in the US depending upon VISA and calendar days/years in the US you will e-file…

J1 VISA – two (2) calendar years in the US (Form 1040NR & Form 8843.

3rd year resident return in calendar year 2024 (Form 1040)

F1 VISA – five (2) calendar years in the US (Form 1040NR & Form 8843);

6th year resident return in calendar year 2024 (Form 1040)

H1B VISA – resident return if VISA received in calendar year 2024 or prior year

How do I file my return?

Lincoln VITA/TCAN will not be able to DO your tax return if filing as a non resident but we are here to help walk you through the process.

Step 1. Sign up here to receive the FSA link via email (Please make sure you use a valid email address, name, and phone number in case the email does not work as some email providers will mark it has spam) Be sure to check all inbox and spam folders. If you DO NOT receive the link after the first week in February, please reach out to (VITA EMAIL)

- You will use the Facilitated Self Assistance link to file your Federal Tax Return (ONLY)

- State returns MUST be done in person at Nebraska Department of Revenue

Step 2. Determine your filing status (See Do I file as a resident or non-resident)

Step 3. Please visit (Our Website) and download all PDF documents to be able to complete your return.

Step 4. Once your return has been completed and/or you have questions you can sign up here (Sign up form) for a zoom appointment to go over your return. (Please make sure you complete all steps before making an appointment)

Step 5. Go to the Nebraska Department of Revenue to complete your state filing at 301 Centennial Mall S, Lincoln, NE 68508. (There is NO option to Efile your state return)

*If you have already left the country and are unable to visit in person you can visit there website to fill out your tax form. You MUST print off your return and all tax documentation and mail it into their office.

Do I file as a resident or non-resident on my tax return?

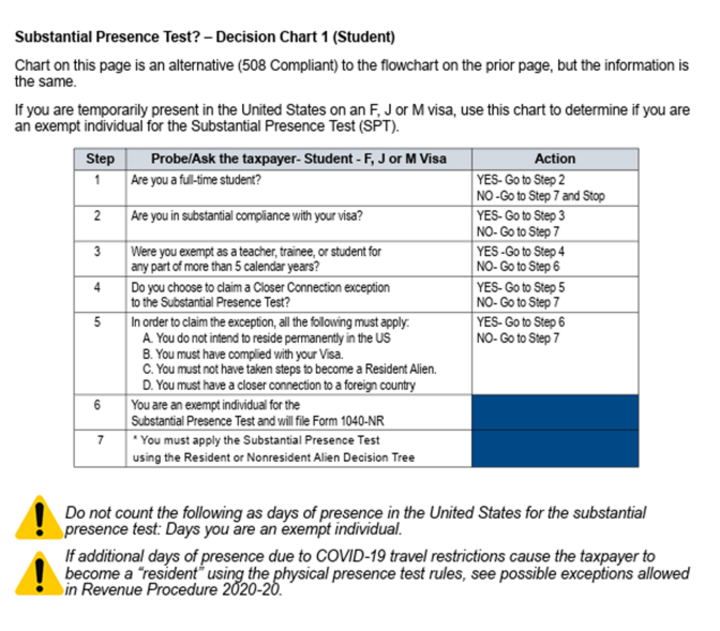

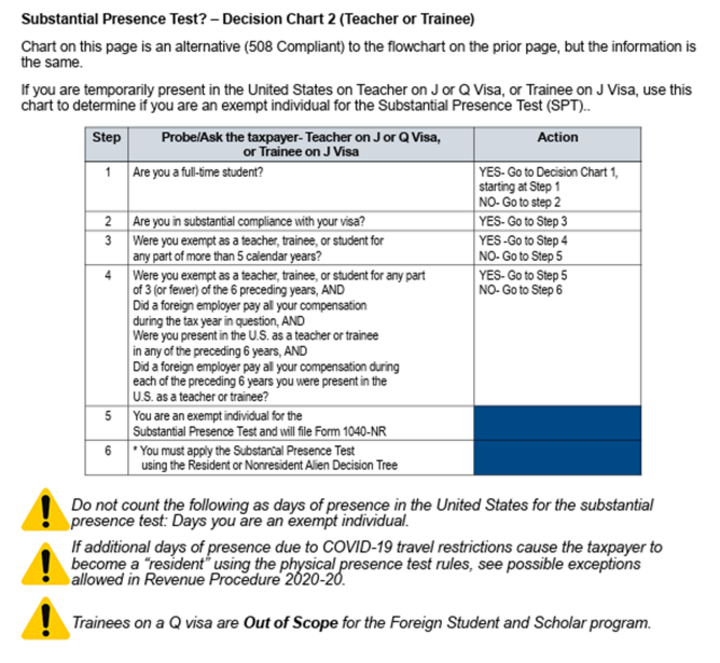

Follow the decision tree to determine how you will file Chart A (Student) Chart B (Teacher) Chart C (is ONLY if you are filing as a resident for tax purposes)

Chart A

Chart B

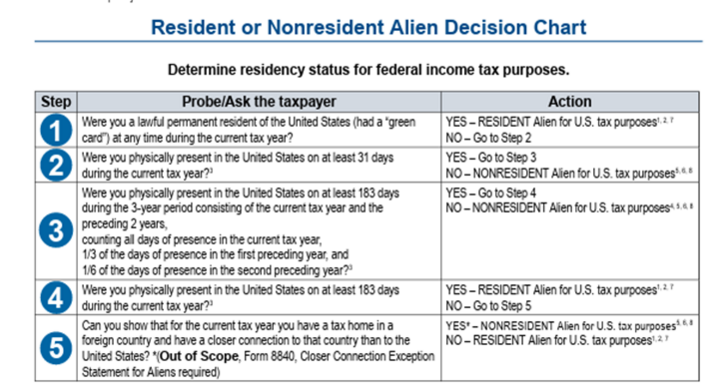

If you are filing as a resident for Tax Purposes refer to Chart C (Below)

For more information visit the IRS website https://www.irs.gov/individuals/international-taxpayers/taxation-of-nonresident-aliens

Can I claim credits on my tax return?

Generally, nonresident aliens cannot claim most U.S. tax credits, particularly those related to education or earned income.

How do I check the status of my return?

Federal Return: https://sa.www4.irs.gov/wmr/

State Return: https://ndr-refundstatus.ne.gov/refundstatus/index.xhtml

What do I do if my return gets rejected?

Sign up to schedule a zoom appointment with VITA and a member of our team will reach out to review and go over your return