How We Help You File

The Tax Credit Alliance of Nebraska (TCAN) offers several ways to get free tax help - whether you want to meet in person, get support online, or file on your own with guidance. This page outlines the different tax preparation and filing services available, including options for international students, off-season filing, and more.

Please note:

Remote appointments are not Zoom calls - they require you to upload your tax documents before your scheduled call with a preparer. Be sure to review the instructions carefully for this option.

How TCAN Supports You

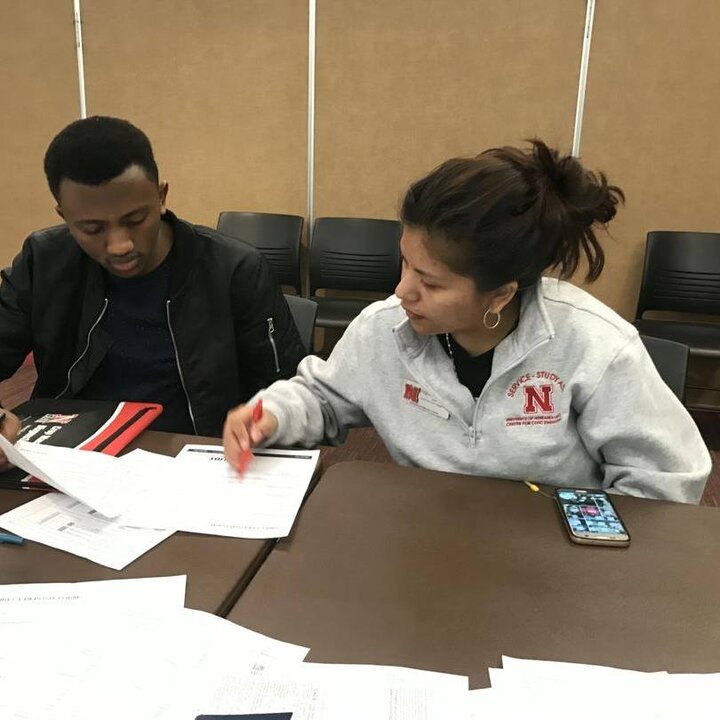

In-Person

In-Person

For the health and safety of everyone involved, you may be asked to wear a mask during your appointment. Each in-person site may have additional safety protocols in place.

Each person filing a tax return requires an individual appointment. (Unless filing married filing jointly) If multiple family members are filing, please have each person schedule an appointment. Please schedule a separate appointment for each tax year you need completed.

Please arrive 10-15 minutes before your scheduled appointment to complete the required paperwork to ensure a smooth and efficient process. While we strive to complete timely returns, please understand that we cannot guarantee your appointment will start precisely on time. Please bring all the required documents to your appointment. Download this checklist to ensure you have what you need.

Remote

This type of tax preparation can be done on your home computer, smartphone, or at your local library. You will need to be able to upload documents from your computer or phone into our secure software platform. Once you make an appointment, A staff member will arrange an agreed-upon time to contact you via phone to gather information needed to begin the process. You will then receive an email describing what you need to do to get started. This email will include an intake form, consent form, and instructions on how to use our online portal and set up your account. You will then receive a second email from our secure portal which will include an invitation link for you to access and set up your account. We will provide you with a support email so you can contact us with any difficulties you may experience.

Your appointment slot does not mean you will speak with a tax preparer at that exact time. Your timeslot only reserves your place in the virtual queue for your selected date. A staff member will contact you after your documents have been uploaded correctly into the software (This includes the intake form, and consent form sent via your first email). After all documents have been uploaded, the tax preparer will begin working on your return within 48-72 hours to complete your tax preparation. A quality reviewer will look over your return then contact you to review your tax return via the online portal and for you to sign the tax return by e-signature. Once signed your return will be transmitted and e-filed.

Facilitated Self Assistance (FSA)

The Facilitated Self Assistance is a (Self Prepared) tax return process. To use this service there are income restrictions to meet to qualify for the free use of this service. If your household makes less than $89,000 and you would like to file your own return, we can provide you free access to TaxSlayer, on online tax software, to file your federal and state returns yourself at no cost.

Due to software restrictions, we cannot post these links publicly. If you’d like to use this service, please fill out the form below. After signing up, you’ll receive an email with secure access instructions for TaxSlayer.

Access begins February 1 of each tax season.

Need tax help as an international student? Explore our International Student section for easy-to-follow instructions, helpful tools, and answers to common questions.

Off-Season Services (outside of Jan 1 - Apr 15):

While regular appointments have ended, VITA may still assist with:

- Current year return

- Prior-year returns (2022 & 2023)

- Amendments/Extensions

- Letters from the IRS

If interested in off-season services, please contact us.